How to Start a Second Income Stream

According to News.com.au, more than 760,000 Australians hold a second job. Having a second income stream can help you pay off debt like small personal loans, save for a big purchase or figure out if a venture is worth pursuing full-time.

In this day and age, there are so many ways you can make extra cash. Some of them can even be 100% online! But where do you start and what are all the things you need to consider before creating a second stream of income? We’ve got you covered. Read on to learn how to start a second income stream.

Overview

- Look for something different from your day job

- Consider following a passion

- Consider passive income

- Make sure it fits your schedule

- Talk to your family and or partner

- Remember it is only temporary

- Learn how to manage your time well

- Understand what you’ll give up

- Start with a contract gig

- Consider whether you need certification

- Keep your business confined

- Don’t make business calls at your day job

- Be willing to start small

- Keep track of receipts and anything else you need for tax purposes

- Know when your second job needs to become your first

How to start a second income stream: 15 tips

1. Look for something different from your day job

If you sit at a desk all day, then consider side jobs that might allow you to get up and move, like becoming a catering waiter or waitress, walking dogs, teaching fitness classes or cleaning houses.

Certainly, the opposite would also hold true – if you’re a personal trainer and on your feet all day, then you might pursue extra income by way of the computer. That way, you can sit down and relax as you earn your additional income.

2. Consider following a passion

If you’re figuring out how to create a second income stream, start by looking at your passions. If you love animals, you could try pet sitting for your neighbours. If you do a great job, then word of mouth should garner you more and more jobs. What about dog walking? If you work hours opposite the normal 9 to 5, then you’re in a great position to do something other people don’t always have time for, like walking their dogs.

Maybe you prefer to-do lists and checking things off. You can offer to run errands for people! You’d be surprised at how much some people hate picking up their dry cleaning, doing grocery shopping or stopping by the pharmacy. So offer to do it for them instead and earn yourself some money.

3. Consider passive income

There are plenty of ways you can earn income without really having to do a lot of work to get it. This is known as passive income. It usually requires you to put in a bit of effort at the beginning. But after that, you can get a regular flow of money that requires only a little ongoing time/energy to earn. Passive income examples include:

- Creating a digital course

- Writing an eBook

- Rental income

- Affiliate marketing

- Selling photography or digital assets

- Renting out a car parking space or your car

4. Make sure it fits your schedule

Don’t overextend yourself. Make sure the number of hours you take making a second income stream won’t prevent you from being able to complete your day job. You still need some time to yourself, and you need to sleep. While it’s great to make extra income, it’s also not worth risking your day job over it.

5. Talk to your family and or partner

Make sure the people in your life are on board with this change in your schedule. It might mean missing something, being less available or just a few less dates. Whatever the case, you will feel better heading into your two-job life if your people are with you.

6. Remember it is only temporary

Always keep in mind that you started this second job for extra income. If you achieve your goal and don’t want to keep up the additional hours it takes, then quit. That’s why it’s a second job – it wasn’t meant for anything other than supplementary income.

7. Learn how to manage your time well

Building a second income stream means you will no longer have all weekend to complete your errands or have long nights of Netflix binging. You need to figure out how you’ll get everything else done in your life when you add this second job. It might be a good idea to get a good planner and keep track of everything there. Or set up a Google calendar that can help you stay on track.

8. Understand what you’ll give up

Like everything in life, you’ll need to weigh up the pros and cons. If you’re at the point of really considering a second job, then it’s probably going to be worth the things you’ll give up. If you remember that this additional money will go toward your goals, then it will be easier to keep on track.

9. Start with a contract gig

Don’t get stuck in what feels like a lifetime commitment. If you’re trying out a new career or pursuing a passion that you hope will turn into a full-time gig, then try it out as a short-term thing. It will give you a chance to see if you can hack a second job and if you like this particular line of work.

10. Consider whether you need certification

If you’re handy and want to make extra money by helping people repair things or even make renovations, you might think about whether you need certification. People are more likely to hire you if you have the qualifications, especially before you get recommendations.

11. Keep your business confined

If you have a home office where you’ll be doing your second job, like freelance editing or writing, you should try to keep that computer and paperwork confined to a space. Even if you don’t have a room to call your office, find a small corner that you can make into an office space.

12. Don’t make business calls at your day job

You won’t last long at your day job if you’re constantly fielding calls from your second job. Make sure people understand your working hours. Or if you’re doing something like house or pet watching, then set up an account where people can email you and only answer those during non-working, first job hours.

13. Be willing to start small

If you’re learning how to start a second income stream to make extra money as well as to pursue a dream, then you need to be willing to start small. Take on any and all gigs you can get, and you’ll find as you have more experience you’ll be able to get higher wages.

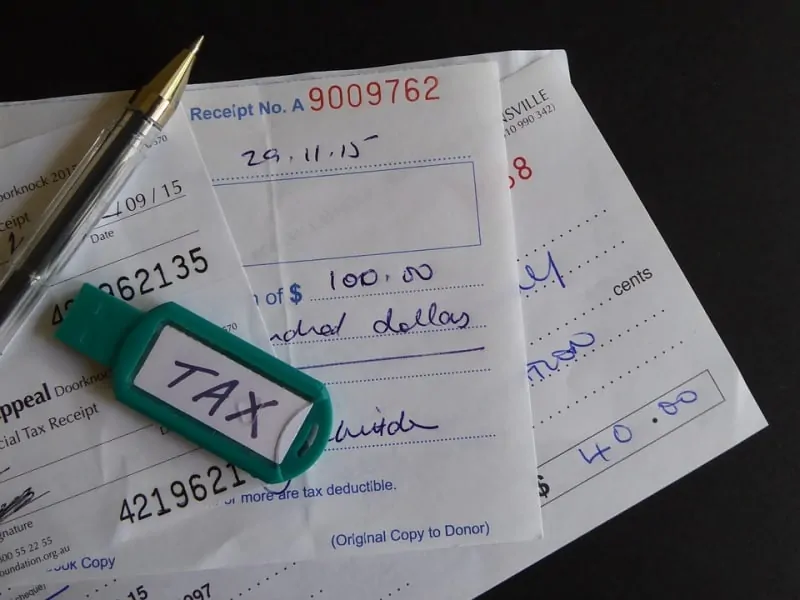

14. Keep track of receipts and anything else you need for tax purposes

Unfortunately, this second source of income won’t come tax free. So make sure whatever you do, you figure out how you need to track it and what you’ll need in order to deal with income taxes.

15. Know when your second job needs to become your first

If you’re lucky, you might stumble onto something that not only provided all the extra income you needed but blossomed into a full-blown business. When you find yourself stretched to the limit and unable to do both jobs well, then it’s time to figure out which one you want to stick with. And then if you need to, you can always find a less consuming gig.

Need help staying on top of your finances?

So now you know how to start a second income stream, it’s time to get out there and start earning extra cash!

If you find that your second job just doesn’t cut it or life throws you for a loop, you might want to consider a cash loan to bridge you through a tough time. At Swoosh Finance, you can apply for an online loan that will get you back on your feet and on your way to fulfilling those financial goals in no time. If you have any questions, please don’t hesitate to get in touch with our friendly team.

How to start a second income stream: FAQs

What is the best passive income?

It ultimately depends on your financial situation and your skillset, but one of the easiest ways to earn passive income is to create digital assets. These could be eBooks, templates, photographs, prints, PDFs etc. All you need to do is create the asset once and then you can sell it repeatedly via your online store or places like Etsy.

How can I have multiple income streams?

It all comes down to time management and making sure you don’t overextend yourself. If you want to set up multiple income streams, opt for ones that are passive and that require little to no ongoing maintenance/time.